Despite vigorous lobbying efforts by many community groups including Realtors through the Greater Capital Area Association Of Realtors (GCAAR), the County Council approved a drastic increase in the Montgomery County real estate taxes, both property taxes and recordation fees. This will hurt homeowners, by raising the cost of owning a home in Montgomery County, will make it more difficult for homebuyers, particularly first-time homebuyers trying to save the large closing costs (including property taxes and recordation fees) needed to purchase a home, and will make worse the struggle of many seniors fighting to stay in their homes on a fixed income.

__________________________________________

Montgomery County Enacts New Taxes on Homeownership

By the Maryland Policy Institute

ROCKVILLE, MD (May 20, 2016) —The Montgomery County Council unanimously adopted $325 million in new taxes on homeownership this week as part of its deliberations on the Fiscal Year 2017 budget. The Council adopted an increase in the home sales recordation tax on Wednesday and an 8.7 percent increase in the property tax on Thursday. The council is expected to adopt the full budget next week.

“County politicians just delivered homebuyers a 1-2 punch,” said Christopher B. Summers, president of the Institute. “Montgomery County already has the State’s highest per capita income tax burden, so making homeownership more expensive only adds to the list of reasons a family should avoid planting roots here. Homebuyers should be viewed as a source of pride, not a source of new tax revenue. The new taxes will also hurt county realtors, who depend on a healthy home buying market for economic security.”

Tax Increase Summary:

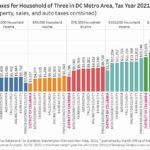

•Property Tax Increase: The Council enacted an 8.7 percent increase in property taxes, pushing the County’s tax rate higher than all surrounding jurisdictions. The average property owner in Montgomery County will now pay $326 more in property taxes every year. County Executive Ike Leggett has stated he expects the increase to raise approximately $140 million from homeowners.

•Recordation Tax Increase: The Council also approved a $180 million increase in the recordation tax on home sales. Under the new tax structure, a house sold for $600,000 would cost about $1,000 more in recordation taxes.

Merely wanna remark that you have a very nice web site, I enjoy the layout it really stands out.

I truly enjoy examining on this site, it has great posts.